Psychological Traps Preventing Saving: The Hidden Mental Barriers to Saving Money

Many people assume that their inability to save stems from not earning enough. However, even individuals with substantial incomes often struggle to build savings. The reason? Psychological traps that shape financial behavior in ways we don’t always recognize. These biases influence how we perceive money, make spending decisions, and prioritize financial goals—often leading to poor saving habits.

For example, some people mentally separate their money into “spending” and “saving” categories without realizing how this affects their overall financial well-being. Others continue spending on things they no longer need simply because they’ve already invested in them. These hidden mental barriers create an illusion of rational financial decision-making when, in reality, emotions and biases drive behavior.

Why Understanding Psychological Traps is Crucial

Overcoming these mental traps is essential for long-term financial stability. Awareness allows individuals to identify self-sabotaging behaviors, make better financial decisions, and create sustainable saving habits. By learning how these biases influence our choices, we can break free from emotional decision-making and build a stronger financial future.

1. Mental Accounting Bias: The Illusion of Money Categories

What is Mental Accounting Bias?

Mental accounting bias is the tendency to categorize money based on its source or intended use rather than treating all money equally. This leads to irrational financial decisions because people assign different values to the same amount of money depending on where it comes from.

For example, a person may treat their salary as “serious money” for bills and necessities while viewing a tax refund as “bonus money” for splurging. Even though both are technically income, they are perceived and spent differently.

How It Affects Saving Habits

Mental accounting can significantly hinder saving efforts by encouraging unnecessary spending. Some common ways this bias manifests include:

- Spending windfalls rather than saving them – People often treat unexpected income (bonuses, gifts, tax refunds) as money to be spent freely rather than an opportunity to boost savings.

- Justifying unnecessary expenses – Someone might refuse to dip into their “vacation fund” for an emergency, even if it’s financially wise.

- Using credit cards differently from cash – Many people spend more on credit cards because they feel detached from the actual loss of money.

Examples of Mental Accounting in Everyday Life

- Tax Refund Splurge – Instead of saving a tax refund, someone may feel justified in using it for a shopping spree.

- Lottery Winnings vs. Salary – A person who wins $1,000 in a lottery is more likely to spend it frivolously than if they received the same amount as part of their paycheck.

- “Free Money” from Discounts – If a person saves $50 using a discount, they might spend that $50 on something unnecessary rather than saving it.

Strategies to Overcome Mental Accounting Bias

- Treat all money as equal – Whether it’s salary, a bonus, or a tax refund, all money should contribute to overall financial goals.

- Redirect windfalls to savings – Automatically transferring unexpected income into savings can prevent impulsive spending.

- Use a single budget framework – Avoid separating funds into rigid categories that limit flexibility and rational decision-making.

2. Sunk Cost Fallacy in Personal Finance: When Past Decisions Control Your Future

Defining the Sunk Cost Fallacy

The sunk cost fallacy occurs when people continue an investment (whether time, money, or effort) simply because they’ve already put resources into it—even when it no longer makes sense. This leads to irrational financial behavior and prevents people from cutting losses.

How It Leads to Poor Financial Decisions

- Holding onto bad investments – Investors may refuse to sell a declining stock, hoping it will rebound, rather than reallocating funds to a better opportunity.

- Continuing unnecessary expenses – Someone might keep paying for a subscription or service they no longer use just because they’ve been paying for it.

- Overcommitting to failing business ventures – Business owners often pour more money into failing projects to “justify” past investments.

Real-Life Examples of Sunk Costs in Saving and Spending

- Unused Gym Memberships – Many people continue paying for gym memberships they never use, reasoning, “I’ve already spent so much on it; I might start going.”

- Expensive Clothes That Go Unworn – Someone who buys an expensive suit but rarely wears it might still avoid selling or donating it because it was costly.

- Bad Business Investments – Entrepreneurs sometimes invest additional money in failing businesses, believing their past investment will eventually pay off.

How to Overcome the Sunk Cost Fallacy in Personal Finance

- Focus on future gains, not past losses – Ask, “Would I buy or invest in this today?” If not, it’s time to move on.

- Make data-driven financial decisions – Base financial choices on current and future benefits rather than emotional attachment.

- Learn to cut losses – Whether it’s a bad investment, an unused membership, or an unnecessary service, eliminating financial drains is essential for long-term savings.

3. Lifestyle Inflation and Saving: The Trap of Growing Expenses

What is Lifestyle Inflation?

Lifestyle inflation occurs when people increase their spending as their income rises, preventing them from saving effectively. Instead of using extra earnings to build wealth, they use it to enhance their standard of living.

How It Prevents Effective Saving

Even if someone’s salary doubles, they may find themselves still struggling financially if they simultaneously increase their expenses. This phenomenon makes it difficult to accumulate wealth despite higher earnings.

The Psychology Behind Lifestyle Creep

- Social Pressure – People feel the need to match their peers’ spending habits, leading to unnecessary upgrades.

- Desire for Instant Gratification – Instead of gradually improving their quality of life, people make impulsive purchases.

- False Sense of Financial Security – Higher earnings create a belief that financial struggles are over, leading to overspending.

Steps to Combat Lifestyle Inflation and Build Savings

- Automate savings increases – Each time income rises, increase automatic transfers to savings accounts.

- Set clear financial goals – Prioritize savings, investments, and long-term financial stability over short-term luxuries.

- Practice mindful spending – Evaluate whether purchases truly add value or are simply driven by external pressures.

- Delay major lifestyle upgrades – Instead of immediately upgrading cars, homes, or gadgets, allow time to assess financial priorities.

4. Overcoming Instant Gratification in Spending: Delaying Rewards for a Better Future

The Science Behind Instant Gratification

Instant gratification refers to the tendency to prioritize immediate rewards over long-term benefits, often leading to impulsive spending. This behavior is rooted in brain chemistry, specifically involving dopamine, a neurotransmitter associated with pleasure and reward.

When we make a purchase—especially one that feels exciting or indulgent—our brain releases dopamine, creating a sense of satisfaction. This chemical response reinforces the desire to continue spending, even when it isn’t financially wise. Marketers and advertisers take advantage of this by creating urgency around products and services, making it even harder to resist impulsive purchases.

Why People Struggle with Delayed Rewards

Humans are naturally wired to prefer immediate rewards over future benefits, a concept known as present bias. This is why saving money for retirement or an emergency fund feels less satisfying than buying something new today. Our brains downplay future rewards, making long-term financial goals seem less urgent.

Other factors that contribute to the struggle with delayed gratification include:

- Social influence – Seeing friends or influencers enjoy luxuries can trigger the fear of missing out (FOMO), leading to impulsive spending.

- Emotional spending – Stress, boredom, or excitement can drive people to seek instant relief through purchases.

- Lack of financial planning – Without clear financial goals, it’s easier to justify spontaneous spending.

How Instant Gratification Affects Long-Term Financial Goals

While instant gratification provides temporary pleasure, it often comes at the cost of financial security. Here’s how:

- Unnecessary spending accumulates – Frequent impulse buys, even small ones, can add up over time, reducing the amount available for savings.

- Delayed financial independence – Spending instead of saving pushes long-term goals further away, such as buying a home, traveling, or retiring comfortably.

- Increased debt risk – Impulsive purchases on credit cards can lead to debt cycles, making it harder to achieve financial freedom.

Practical Techniques to Develop Delayed Gratification

Overcoming the impulse to spend requires intentional strategies to shift focus from immediate desires to long-term goals. Here are some practical techniques:

1. Follow the 30-Day Rule

Before making a non-essential purchase, wait 30 days to see if you still feel the same urge. More often than not, the excitement fades, and the money can be saved instead.

2. Use Budgeting Apps to Visualize Long-Term Gains

Apps like YNAB (You Need a Budget), Mint, or PocketGuard help track spending habits and set financial goals. Seeing progress toward savings goals can be just as rewarding as a purchase.

3. Set Automatic Savings Contributions

Automating savings ensures money is set aside before it can be spent. This creates a “pay yourself first” habit, prioritizing long-term wealth over short-term wants.

4. Reward Yourself for Saving

Delayed gratification doesn’t mean depriving yourself entirely. Set small milestones in your savings journey and reward yourself in ways that align with your goals, such as a guilt-free treat or experience.

5. Create Spending Barriers

Make it harder to spend impulsively by:

- Removing saved payment methods from online stores.

- Implementing a cash-only rule for discretionary spending.

- Using a wishlist instead of buying instantly—if an item remains on the list for months, it may be worth purchasing.

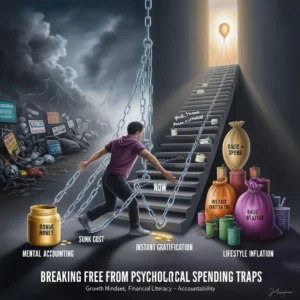

5. Breaking Free: A Holistic Approach to Smarter Saving

Identifying and Challenging Your Own Psychological Traps

To break free from the biases preventing saving, it’s crucial to first identify them. Ask yourself:

- Do I spend more freely when I receive unexpected money? (Mental Accounting Bias)

- Am I holding onto expenses just because I’ve already paid for them? (Sunk Cost Fallacy)

- Do I increase my spending every time I get a raise? (Lifestyle Inflation)

- Do I struggle to delay purchases even when I know I should save? (Instant Gratification Bias)

Awareness is the first step toward change. Once you recognize these traps in your financial habits, you can actively work to overcome them.

Developing a Mindset for Long-Term Financial Success

- Shift focus from income to wealth-building – High earnings mean little if savings don’t grow alongside them.

- Redefine success – True financial success isn’t about what you own today, but the freedom and security you build for the future.

- Adopt a growth mindset – Financial habits can be improved over time, and setbacks are learning opportunities rather than failures.

Using Tools and Resources for Better Saving

Leverage available resources to stay accountable and maintain financial discipline:

- Budgeting apps – Tools like Mint, YNAB, or EveryDollar help track and manage spending habits.

- Financial planners – Working with a financial advisor can provide professional guidance tailored to your goals.

- Accountability partners – Sharing financial goals with a trusted friend, family member, or mentor helps maintain motivation and discipline.

Breaking free from psychological spending traps requires consistency and commitment, but the rewards—financial security, peace of mind, and freedom—are well worth it.

6. Conclusion

Summary of Key Takeaways

- Psychological biases such as mental accounting, the sunk cost fallacy, lifestyle inflation, and instant gratification prevent people from saving effectively.

- These biases lead to irrational financial behaviors, such as spending windfalls, holding onto bad financial decisions, or prioritizing short-term pleasures over long-term wealth.

- Recognizing these mental traps is the first step toward smarter saving and financial independence.

- Practical strategies—such as the 30-day rule, automating savings, delaying gratification, and using budgeting tools—can help individuals take control of their finances.

Encouragement to Recognize and Break Free from Psychological Traps

Many people unknowingly fall into these traps, but financial success is within reach for those willing to challenge their habits. By changing how we think about money, we can develop healthier financial behaviors that lead to long-term stability and success.

Actionable Next Steps to Improve Saving Habits Today

- Identify your biggest financial bias – Which psychological trap affects you the most?

- Implement one saving strategy this week – Try the 30-day rule, automate savings, or reduce impulse spending.

- Track your progress – Use an app or journal to see how these changes impact your savings over the next month.

- Stay accountable – Share your goals with a friend or use a financial advisor for guidance.

By taking these steps today, you’ll build the foundation for a more secure and financially free future. 🚀