Financial Freedom refers to reaching a stage where your investments, savings, and passive income streams cover your living expenses, allowing you to live without relying on a paycheck. It means having the ability to make life choices based on what you truly want rather than financial necessity.

While many people focus on strategies like investing, budgeting, and earning more money, the foundation of wealth-building success lies in mindset. Your beliefs about money, risk, and opportunities shape the financial decisions you make every day. A strong mindset helps you stay disciplined, make smart choices, and persist through challenges on the road to financial independence.

Achieving financial freedom isn’t just about numbers—it’s about mindset, habits, and financial strategies working together. A wealth-building mindset helps you develop smart habits, such as investing consistently, managing expenses wisely, and continuously learning about money. Without the right mindset, even the best financial strategies won’t be effective.

1. The Role of Mindset in Wealth Building

Your thought patterns influence financial decisions in powerful ways. If you believe that wealth is only for the lucky or that financial success is out of reach, you’ll likely make choices that reinforce those beliefs—such as avoiding investments or overspending because “money comes and goes.”

The psychology of money is shaped early in life. Childhood experiences, parental attitudes about money, and societal messages create deep-seated financial habits. For example, someone who grew up in a household where money was always a struggle may subconsciously fear losing wealth, leading to overly cautious decisions or self-sabotage when financial success starts to build.

Many successful individuals have transformed their financial situation by shifting their mindset. Take Warren Buffett, who began developing a long-term investment mindset as a child, or Oprah Winfrey, who overcame poverty by focusing on opportunities rather than limitations. These examples show that financial freedom is attainable when you adjust how you think about money.

2. Developing a Financial Independence Mindset

A Financial Independence Mindset is different from traditional financial thinking. Instead of focusing on working for money, it prioritizes making money work for you through investments, passive income, and financial planning. Unlike paycheck-to-paycheck thinking, it emphasizes long-term wealth-building over short-term consumption.

To adopt this mindset, you must shift from scarcity thinking to abundance thinking. Instead of believing there’s never enough money or that wealth is only for a select few, focus on opportunities to grow your income, acquire financial knowledge, and leverage assets.

Overcoming fear and limiting beliefs is also crucial. Common myths like “money is evil” or “I’ll never be rich” prevent people from taking proactive steps toward wealth. By recognizing and challenging these beliefs, you can reframe money as a tool for creating freedom and impact rather than a source of stress.

Long-term financial planning plays a key role in maintaining this mindset. Prioritizing investment growth, passive income, and financial security over short-term luxuries ensures sustainable wealth. Instead of chasing quick financial wins, focus on strategies like consistent investing, smart saving, and business growth.

3. Building an Abundance Mentality in Finance

An abundance mentality in finance is the belief that wealth and opportunities are limitless rather than scarce. It allows people to see financial success as achievable for everyone, rather than a competition where only a few win. This mindset fosters innovation, generosity, and confidence in financial decision-making.

Actionable Steps to Train Your Brain for Financial Abundance:

- Reframe challenges as opportunities – Instead of seeing financial difficulties as setbacks, view them as learning experiences that build resilience.

- Surround yourself with positive financial influences – Follow successful entrepreneurs, investors, and financial educators who reinforce an abundance mindset.

- Invest in financial education – The more you learn about wealth-building strategies, the more confident you become in making smart financial choices.

Gratitude, generosity, and positive thinking also play a huge role in attracting wealth. Studies have shown that people who practice gratitude are more likely to take financial risks that lead to long-term gains. Generosity fosters a sense of abundance and often leads to new opportunities. Maintaining a positive attitude helps you stay motivated during setbacks.

Real-Life Success Stories of an Abundance Mindset:

- Tony Robbins – Grew up in financial hardship but adopted an abundance mindset, leading him to build a multi-million-dollar empire.

- Sara Blakely – The founder of Spanx credits her success to believing in possibilities rather than limitations, even when faced with rejection.

By shifting your financial mindset and adopting an abundance mentality, you set yourself up for lasting wealth and financial freedom.

4. Money Mindset Transformation: Steps to Change Your Financial Reality

Identifying Limiting Money Beliefs

Many people unknowingly hold onto limiting money beliefs that shape their financial decisions and keep them from achieving financial freedom. These beliefs are often ingrained from childhood or influenced by societal norms. Common examples include:

- “Money is hard to earn.”

- “Rich people are greedy or dishonest.”

- “I’ll never be wealthy because I don’t come from money.”

- “Investing is risky and only for the wealthy.”

To break free from these limitations, start by recognizing and challenging them. Ask yourself:

- Where did this belief come from?

- Is it based on facts or fear?

- How does this belief impact my financial decisions?

Mindset Exercises to Transform Your Relationship with Money

Changing your money mindset requires intentional mental exercises that reinforce positive financial beliefs. Some powerful techniques include:

- Affirmations: Repeating positive money statements like “I am capable of creating wealth” or “Money flows to me easily” can help reprogram subconscious fears about money.

- Visualization: Imagine yourself achieving financial freedom—owning your dream home, traveling without financial stress, or giving generously. This practice strengthens belief in your financial goals.

- Journaling: Write about your financial goals, successes, and mindset shifts. Reflecting on progress helps reinforce positive changes.

Rewiring Financial Thinking for Success

To develop a wealth-oriented mindset, replace negative thoughts with empowering beliefs:

- Instead of “I can’t afford this,” say “How can I afford this?” to encourage creative problem-solving.

- Instead of “Investing is too risky,” think “Learning to invest wisely will help me grow my wealth.”

- Instead of “I’ll never be rich,” affirm “I have the ability to build wealth over time.”

Daily Financial Habits That Reinforce a Strong Money Mindset

Your daily actions should align with your financial goals. Key habits include:

- Tracking expenses to stay aware of where your money goes.

- Reviewing financial goals regularly to stay focused.

- Consistently learning about money management through books, podcasts, and courses.

- Practicing gratitude for financial progress, no matter how small.

5. Practical Strategies for Achieving Financial Freedom

Budgeting & Smart Money Management

A solid budgeting system is the foundation of financial success. Effective money management includes:

- Tracking expenses to understand spending habits.

- Setting clear financial goals (short-term and long-term).

- Using the 50/30/20 rule (50% needs, 30% wants, 20% savings/investing).

- Automating savings to ensure consistent financial growth.

Investing for Wealth

Wealth-building requires investing for long-term growth. Key principles include:

- Start early to take advantage of compounding interest.

- Diversify investments across stocks, real estate, and other assets.

- Think long-term—avoid panic-selling or chasing quick returns.

- Learn about different investment vehicles (stocks, ETFs, real estate, etc.).

Multiple Income Streams

Relying on a single paycheck limits financial growth. Financial freedom comes faster with multiple income sources, such as:

- Passive income (rental properties, dividends, royalties).

- Side businesses (freelancing, consulting, e-commerce).

- Investing (stocks, bonds, real estate, cryptocurrency).

Debt Management

Debt can be a major barrier to financial freedom. Strategies for managing debt effectively include:

- Using the avalanche or snowball method to pay off debts strategically.

- Avoiding high-interest debt (credit cards, payday loans).

- Building an emergency fund to prevent future reliance on debt.

- Investing while paying off debt to continue wealth-building.

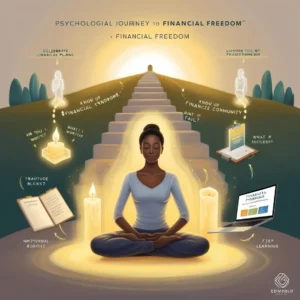

6. The Psychological and Emotional Aspects of Financial Freedom

Overcoming Emotional Struggles in Financial Growth

Many people face emotional challenges on their financial journey, including:

- Imposter syndrome—feeling undeserving of wealth.

- Fear of success—worrying that financial success will change relationships.

- Guilt around money—especially for those who grew up with financial struggles.

Managing Financial Stress and Staying Resilient

Money can be a major source of stress, but practical strategies help manage it:

- Creating a financial plan to feel more in control.

- Practicing mindfulness and gratitude to reduce financial anxiety.

- Seeking financial education and mentorship for guidance.

- Developing a strong support system to stay motivated.

Staying Motivated and Disciplined on the Journey

Achieving financial freedom requires consistency and discipline. To stay on track:

- Celebrate small wins—every financial milestone matters.

- Remind yourself of your “why”—whether it’s freedom, security, or legacy.

- Surround yourself with like-minded people who inspire financial success.

- Keep learning—financial growth is a lifelong journey.

Financial freedom isn’t just about making more money—it’s about developing the right mindset, habits, and financial strategies. The journey starts with shifting limiting beliefs, embracing an abundance mindset, and taking consistent financial action.

By budgeting wisely, investing for long-term wealth, creating multiple income streams, and managing debt effectively, anyone can achieve financial independence.

Commit to continuous learning and growth, and remember: financial freedom is possible for anyone who takes the right actions. The journey may take time, but the rewards—security, peace of mind, and true financial independence—are well worth the effort.